People with dementia often have difficulties in managing their finances, possibly due to a decline in their arithmetic abilities, increased forgetfulness, and impaired judgement. As a consequence, they may be more vulnerable to financial abuse such as theft, exploitation, or fraud than others. It is widely recognised as necessary to inform families and carers about potential vulnerabilities and to offer suggestions to prevent and minimize risk of harm and loss.

What is the experience of community services staff regarding problems related to the financial management by people with dementia? Is it possible to identify particular risk factors to prevent financial abuse? Kritika Samsi, Jill Manthorpe, and Karishma Chandaria surveyed voluntary sector (not for profit) staff working in dementia services in the UK and found that most had worked with people with dementia who had problems in managing their money. Almost all workers stated that they regularly try to discern signs of vulnerability in people with dementia but feel that further co-operation between professionals is needed to respond to suspicious behaviour and possible abuse. What can professionals do to reduce risks? Practitioners should inform families and alert local authorities if a person with dementia is being abused. Staff working in financial institutions, such as banks, should be more alert to suspicious behaviour by people accompanying customers with dementia or unusual patterns of cash withdrawal, and schedule regular checks for clients with dementia to see that all is well.

More support to reduce risks

In response to this growing concern about the vulnerability and risk of financial abuse of people with dementia, the UK government is implementing policies to encourage the voluntary and non-profit sector to further support people with dementia in order to reduce risks of exploitation and harm. These include working with banks and other financial institutions to raise their awareness of dementia and information sharing.

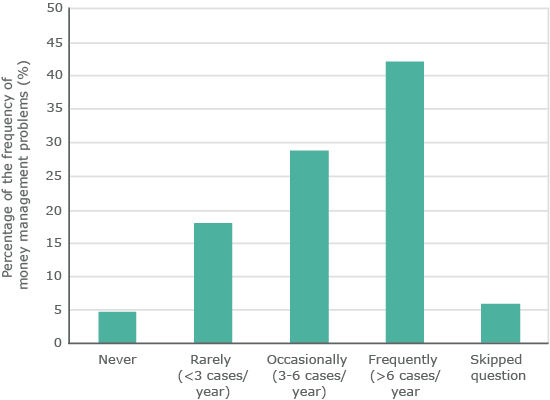

Samsi and her colleagues found that almost half of those who support people with dementia on a daily basis report that they frequently meet clients who have had problems with money management (Figure 1); only 5% of participants say that they have never encountered clients with such issues.

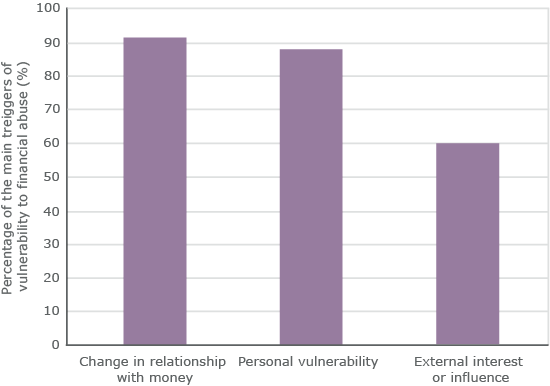

The authors also identify three main situations that might act as triggers of vulnerability for financial abuse. The first is a change in the relationship with money; 91.6% of staff note that people with dementia become confused about money. Some no longer recognise the value of money and have problems counting change. The second trigger regards personal vulnerability: 88% of respondents indicate personal vulnerability as a facet of dementia. People with dementia could be more vulnerable to possible abuse because they often do not know who to trust or get easily involved in exploitative activities by ‘false friends’. Finally, 60.2% recognise the unexpected and questionable presence of an external interest or influence in the lives of people with dementia (Figure 2) as another sign of danger.

Figure 1. Percentage of the frequency of money management problems or queries in day-to-day work with people with dementia (n=83).

Figure 2. Percentage of the main triggers of vulnerability to financial abuse of people with dementia (n=83).

This Population Digest has been published with financial support from the Progress Programme of the European Union in the framework of the project “Supporting a Partnership for Enhancing Europe’s Capacity to Tackle Demographic and Societal Change”.